rhode island tax table

According to the American Petroleum Institute the Ocean State has the 7th-highest tax on regular gas in the country. Find your pretax deductions including 401K flexible account contributions.

Latest Tax News.

. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. 2016 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

However if Annual wages are more than 227050 Exemption is 0. The state income tax table can be found inside the Rhode Island 1040 instructions booklet. Masks are required when visiting Divisions office.

PPP loan forgiveness - forms FAQs guidance. Head of household 13550 RETURN MUST BE SIGNED - SIGNATURE IS LOCATED ON PAGE 2. Rhode Island Division of Taxation.

How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Any income over 150550 would be taxes at the highest rate of 599.

Rhode Island Standard Deduction Single 9050 Married filing jointly or Qualifying widower 18100 Married filing separately 9050 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Tax Rate Starting Price Price Increment Rhode Island Sales Tax Table at 7 - Prices from 4780 to 9460 Print This Table Next Table starting at 9460 Price Tax 4780 335 4800 336 4820 337. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect.

2022 IFTA Return Filing Guidance - April 26 2022. 2022 Rhode Island Sales Tax Table. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Rhode Island State Income Tax Rates and Thresholds in 2022.

Find your gross income. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect your applicable local sales tax rate. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

3 rows The Rhode Island tax tables here contain the various elements that are used in the Rhode. This page has the latest Rhode. Find your income exemptions.

Rhode Island Estate Tax. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of. Selecting option 3 or by visiting the Rhode Island Division of Taxations website at wwwtaxrigov.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. This excise tax totals 34 cents per gallon.

2022 Filing Season FAQs - February 1 2022. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The state sales tax rate in Rhode Island is 7 but.

Rhode Island Alcohol Tax. 2022 RI-1040ES Rhode Island Resident and Nonresident Estimated Payment Coupons FILE ONLY IF YOU ARE MAKING A PAYMENT OF ESTIMATED TAX DUE DATE JANUARY 15 2023 ITE 1. Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below.

Exemption Allowance 1000 x Number of Exemptions. Rhode Island Gas Tax. We last updated Rhode Island Tax Tables in.

The tax on diesel is also 34 cents per gallon 9th-highest in the country. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. 62550 142150 CAUTION.

Rhode Islands 2022 income tax ranges from 375 to 599. RHODE ISLAND TAX RATE SCHEDULE 2018 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 62550 142150 But not over Pay--of the amount over 375 475 599 on excess 0 62550 142150. 5 rows More about the Rhode Island Tax Tables.

2022 Rhode Island Sales Tax Table. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550 648913 599 over 150550. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. ENTER AMOUNT DUE AND PAID 0 0 YOUR SOCIAL SECURITY NUMBER.

One Capitol Hill Providence RI 02908.

Rhode Island State Tax Tables 2022 Us Icalculator

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Form Sales Tax Rate Table Fillable 7 Tax Rate

Rhode Island Income Tax Brackets 2020

Facts And Stats 2018 U S Census Data Analysis On Poverty And Income Economic Progress Institute

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Higher Education In Rhode Island 1993 2016 Ballotpedia

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

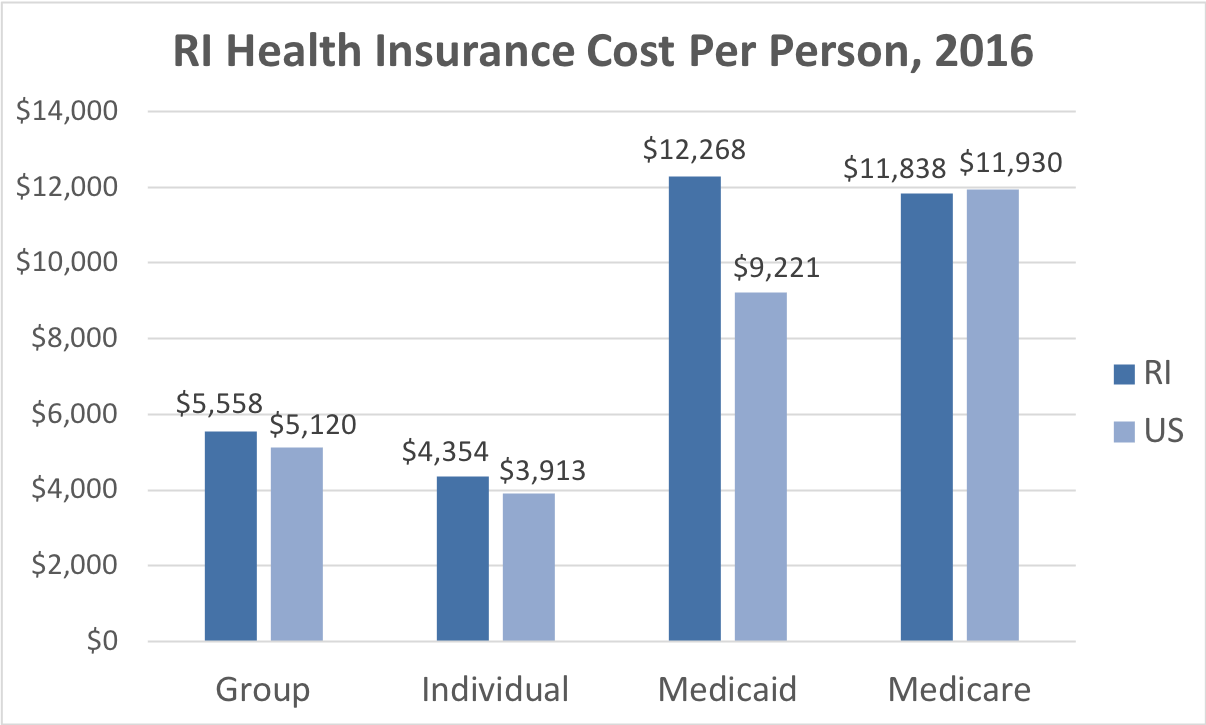

Rhode Island Health Insurance Valchoice

Report Confirms Rhode Island Taxes Are Regressive Ri Future

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Income Tax Ri State Tax Calculator Community Tax